It has often been reported that Albert Einstein once claimed that “Compound interest is the eighth wonder of the world,” or “compound interest is the most powerful force in the universe.” These claims are almost certainly nonsense. One, more reliable quote does involve Einstein being asked about the greatest invention of all time and he responded in jest, “compound interest.” None of the other quotes attributed to him on the topic appear until long after his death. In fact, we can document that Einstein purchased a 3 or 4% annuity as an investment around 1933. This would seem to fly in the face of his supposed fixation on compounding. With that minor history lesson behind us, we can make better use of our time by focusing on why such a pseudo-quote might be believed. While, there are thousands of more complex ways to make the point, let’s focus on a simple one here.

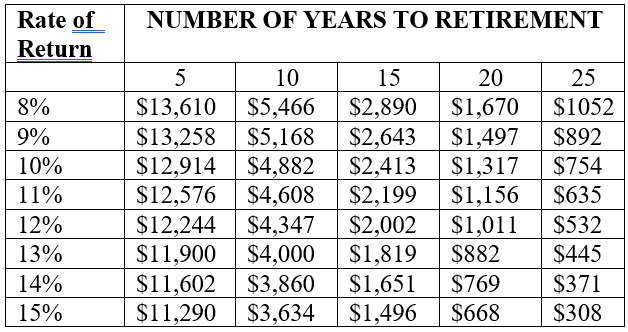

The table shown here displays the monthly deposits needed to accrue $1,000,000 after some number of years given some assumed rate of annual return. The return rates range from 8% up to 15%. As a point of reference, the long term average for the S&P 500 is around 10%. Small cap stocks and emerging market stocks can yield closer to 12 or even 13%, albeit with a much higher variance. If anyone promises 14 or 15% long term returns, RUN, because you are about to be sold a pile of bovine excrement, but I leave those data points here to show some sort of upper bound.

There are two sets of variables that can be altered in this example. However, I am going to state them in a way that may not be so obvious. The most obvious improvement would come from increasing the rate of return. We see this effect as we move up and down a column in the table. This is largely outside of your control. It is true that you can consider a mix of investments to include more small-cap stocks of international stocks. Realistically, this may move you from 10% to 11 or even 12%. If we consider a 15 year planning horizon, this would mean that we could drop the monthly contribution needed to reach our million dollar target from $2,413 to $2,199. In other words, you could reach the same endpoint while dropping the monthly contribution by about 8.8%.

On the other hand, consider investing with a 20 year horizon instead of 15. This may be completely under our control, and we can see its effect by moving left and right in a row of the table. As we move from 15 over to 20, we could drop the contribution from $2,199 to $1,156 per month. Thus, you reach the same endpoint while dropping the monthly contribution by about 47%. This is the power of compounding. With no increase in the rate of return, we can drop the principal invested per month by almost 50% if we start 5 years earlier. This explains why we say that the best time to start investing is simply NOW!. The earlier we start the better, and since we cannot travel back through time, our best option is always the same. Invest as much as possible, as soon as possible, and let it grow as long as possible.

Let’s take this a step further. Imagine, that we start with 25 years to go before retirement, and we get an employer that will match our contributions up to 5%. Under those terms, we may be more comfortable with a higher allocation to small-cap, value, and international stocks. This should produce returns that average closer to 12%. With this rate of return we are looking at a required investment of $1,100 per month. If the employer is providing half of this amount, we are looking at an out of pocket contribution of $550. This works out to $6,600 per year, which is 5% of $132,000. Perhaps more realistically, this would be 10% of $61,000. This should start to look doable for most households.

Notice, that I said “doable” – – not easy. If you want easy – you are reading the wrong material. But if you want possible, after a bit of struggle, we can help with that. Remember – “IF THERE IS NO STRUGGLE, THERE IS NO PROGRESS!”