Let me give credit where it is due up front. This blog title is not from my own mind. I borrowed it from a number of places including a presentation from a GMU Professor, Tyler Cowen given back in 2018. Fortunately, the fundamental observations don’t really change. The Professor’s basic message was (and remains) that if you only understand 2 words about economics those words should be, “Incentives Matter.” Now, I know that for most people the response to this statement is something like, “No joke genius,” but hear me out.

The professor offers a number of examples. Multiple researchers have found that when tipping is banned in restaurants the quality of service goes down. Right after a company goes public, the divorce rate among its employees jumps. (It’s easier to get a divorce when you have money to pay for it.)

Here are a few more examples from one of my favorite podcasters, Ben Felix. (See: https://www.youtube.com/watch?v=GlmzhT6Xblw&t=4263s)

- Content creators (including me) have a huge incentive to generate clicks and FEAR always does that better than boring old information. As a result, the scary story that you read should be treated with a high level of skepticism.

- Financial advisors have an incentive to make investing seem more complicated than it really is. A rational, risk-neutral decision maker doesn’t need much help.

- A lot of Mutual Funds are still sold on a commission basis while index funds are not. For many advisors the only way they make a living is by selling actively managed mutual funds. Maybe that’s why you keep hearing that message.

- When a firm shows you a report of Fund performance, they have an incentive to NOT show you the performance of the funds that they closed when they went down in value.

Here is a related line from Warren Buffett. “If you have a choice on Wall street between being a great analyst or being a great salesperson. Salesperson is the way to make it. If you can raise $10 Billion in a fund and you get a 1 and a half percent fee and you lock people up for 10 years, you and your children and your grandchildren will never have to do a thing (even) if you are the dumbest investor in the world.”

You may ask what all of this has to do with your money. Well, the answer is pretty simple. If a Planner/Advisor/Manager or whatever title you want to use is paid based on funds under management, you should recognize that they have a huge incentive to tell you a few basic things like:

- You will never have enough money to retire.

- Withdrawing 4% of your assets every year is far too much, and

- Investors who use an advisor will outperform the market by 3-4% per year.

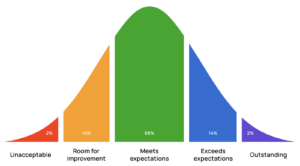

That last one always makes me smile. The overwhelming majority of funds invested each year is done by professional managers of some sort. If they all outperformed the market by 3-4%, then the market would have to be 3-4% higher than the market. [But that doesn’t make sense.] Exactly my point!

On the other hand, if someone is paid based on the number of transactions that are processed they have a great incentive to say things like:

- We really need to rotate out of these sectors into new ones because something has happened,

- The latest rankings show the best funds from last year. We should move your money there now, and

- Our new analysis shows the 10 stocks to buy right now.

Please notice that I am not trying to argue that your advisor is a dishonest player. It’s just like the famous line from Upton Sinclair,

“It is difficult to get a man to understand something, when his salary depends upon his not understanding it.”

Upton Sinclair

When you tell your advisor that spending almost never keeps up with inflation in retirement, and that eliminating the mortgage makes living off of social security pretty easy for most people, he is likely to be unable to understand the words that are coming out of your mouth. Or if you say something like Warren Buffett’s famous line, “My preferred holding period is forever,” your stock broker will have no understanding of what you mean.

It’s not his fault. He is simply paid to speak a certain way, and it’s really going to be hard for him to say the opposite in any month where his mortgage payment is due – and it’s always due within the next 30 days.

Keep this in mind when you think about products like annuities. Remember that the commission to the seller of the annuity is virtually always at least twice as high as what he/she makes selling you anything else. (In all likelihood, I have just told you everything that you really need to know about annuities.)

Perhaps the essential point can be made more directly by stating, “When advice is given, ask yourself how the person giving it gets paid!!!” Always be hyper-skeptical of any advice if having you follow that advice puts money into the pocket of the person giving it. We know that there is a problem with my advice as well. If the speaker/writer, etc. is not being paid to say something, they probably won’t have much to say. (Fortunately, that’s never been a problem with me!!)

Since those paid (in some way) to speak will do most of the talking, almost all of the advice that you hear will be biased in some way. We are simply making the argument that the opinion of a paid spokesperson can NEVER be a sufficient argument to do what is being advised.