Whatever you do in this space, don’t ever admit that the 4% rule is nonsense. If you do, you will be publicly flogged and left for dead for being such a monstrous idiot. Oh well, here it goes!!!

I have approached this topic from an economic perspective elsewhere, so for the most part, I will leave that mathy gobbledygook where it is, but here is the really short version. Anyone with Constant Relative Risk Aversion assigns a utility level of negative infinity to the outcome of running out of money. That’s an egghead’s way of saying that no one seriously uses a strategy that creates a positive probability of doing that. In other words, we don’t voluntarily run out of money because we are not stupid. When the balance starts to fall, we adjust the plan before it all collapses. No one spends all of their money simply because he had a policy that says he has to do it. The 4% rule was only meant to be a conversation starter – not the gospel according to anyone. Case closed.

However, I recently ran across a small white paper from BlackRock that caught my attention because the authors seemed to be amazed by what I suspect all retirees would consider to be obvious. Here are a few samples:

“Almost 3 quarters of retirees said they had enough income on hand and didn’t need to draw down assets.”

In other words, most of the people with sizable retirement accounts eventually realize that they don’t actually need them on a regular basis. They hold the money for emergencies and big events like long term care. Very few people live their entire adult lives spending 80 or 90% of what they bring home and suddenly become a person who spends 110% because they retired. Most people find that they didn’t need most of the stuff they spent money on when they were working anyway, and become quite content in retirement only spending on what is actually needed and stopping there. Much of our spending when we work is to deal with stress. Once the stress from the crappy old job is gone, a lot of the spending goes along with it. Let’s move on.

“For the majority of retirees, spending is the variable that they have the most direct control over, and the vast majority (80%) feel knowledgeable about how much they can afford to spend each year.”

What a shock – people who have lived within their means for the past 40 or 50 years, actually know how to do it without an elaborate spreadsheet, or a high paid advisor? Amazing!!! Who would have ever guessed that – Everybody!!!

“More than 50% of retirees plan their spending so that their account balances don’t fall below a certain amount and over half also agree that they would stop spending and try to build the balance back up if balances fell below their threshold level.”

Inconceivable – do you actually mean to say that most retirees have a spending plan – and it is NEVER “Spend 4% in year 0 and then increase it each year with inflation no matter what the balance is.” Duh!!!

Digging a little deeper into the paper we see that apparently, 16% plan to spend more in the early years of retirement for travel or other purposes and then cut back as they age. 43% plan to spend consistently, unless they begin to see the balances drop.

It also turns our that for retirees that have asset level related goals in retirement, over half plan to increase the balances and will manage spending to help make that happen. As the study reports:

“Those who plan to increase assets were more comfortable with risk, more consistent in spending, less worried about a financial crisis, and were planning to leave an inheritance.”

Again, people who have managed their money all of their lives without paying anyone to do it for them don’t turn their brains off and withdraw 4% because an arbitrary rule says so.

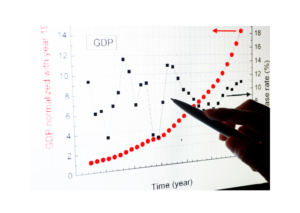

It also appears that attitudes towards risk evolve over time. The big news here (to those who apparently never paid attention) is that older retirees are often less risk-averse than more recent retirees. Not to be macabre to here – but people eventually realize that the longer they live, the less future retirement they have to fund. The survey found, “Those retired for more than 10 years are more comfortable than recent retirees with substantial investment risk.”

This is not to say that risk is not considered, or that everything is perfect. Retirees with pensions are more comfortable with spending assets, are less likely to draw down those assets, and have fewer concerns about the economic future. But the bottom line is that

“Relatively few retirees even feel the desire to spend down the assets that they have.”

In fact, it appears that the biggest challenge that advisors have with retirees with significant funds in retirement accounts is not getting them to avoid over-spending, but getting them to spend any of the money at all.

A famous analysis from Poterba, Venti, and Wise in 2012 found that 70% of retirees with sizable retirement account balances reported making no withdrawals from those accounts in the last 12 months. This holds even for retirees above the age of 72 with Required Minimum Distributions. Roughly, 70% of accounts in such cases have RMD’s, yet most retirees don’t view this as spendable income. Apparently, it is common to simply move the funds from a retirement account to some other account. In our mental math we often don’t think of this as a withdrawal – just moving money from one bucket to another. This reluctance to spend down retirement savings is known as the “Retirement Savings Puzzle.”

I have never understood what is puzzling about this. People don’t like watching balances go down, so they don’t spend the money if they don’t have to, and most people with significant assets simply don’t have to.

What’s the final point here? A rule of thumb is easy to sell, and easy to use to scare people into giving you control of their money (for a small fee of course.) However, its quite hard to force people to actually use the rule, for the simple reason that it’s a dumb rule. Each of us will find a spending style that fits with who we are. One of the main goals of this site is to improve your understanding of how the technical and financial issues play out. This will alloy you to take that information into account as you figure out your personality-specific approach. No restrictive rule fits every person or should ever be treated as ultimate truth.